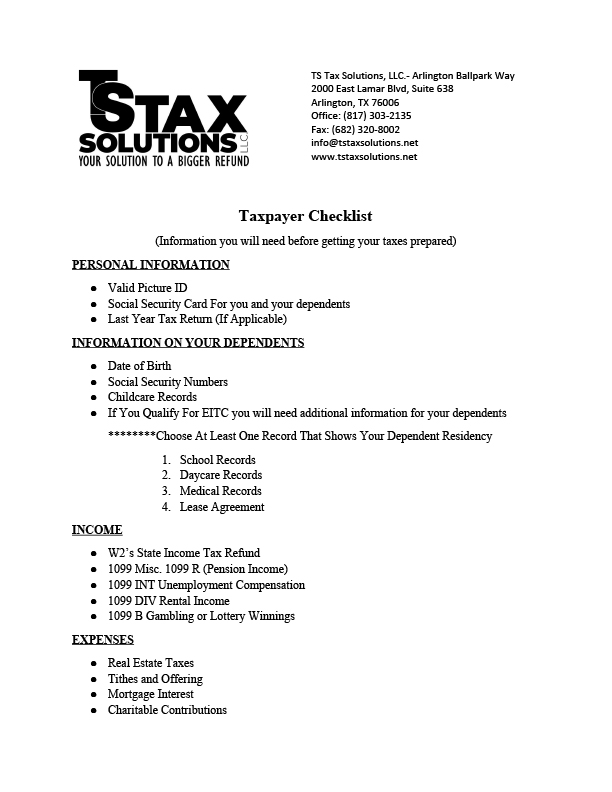

Taxpayer Checklist

personal information

Valid Picture ID

Social Security Card

For you and your dependents Last Year Tax Return (If Applicable)

INFORMATION ON YOUR DEPENDENTS

Date of Birth

Social Security Numbers

Childcare Records

If You Qualify For EITC you will need additional information for your dependents

********Choose At Least One Record That Shows Your Dependent Residency

School Records

Daycare Records

Medical Records

Lease Agreement

Income

TW2’s State Income Tax Refund

1099 Misc. 1099 R (Pension Income)

1099 INT Unemployment Compensation

1099 DIV Rental Income

1099 B Gambling or Lottery Winnings

EXPENSES

Real Estate Taxes

Tithes and Offering

Mortgage Interest

Charitable Contributions

Employee Business Expenses

Student Loan Interest

Moving Expenses

Private Mortgage Insurance

EDUCATION EXPENSES

Form 1098T

Receipts for Tuition and Books

SMALL BUSINESS EXPENSES

Advertising

Repairs and Maintenance

Commission

Supplies

Office Expense

Taxes and License

Insurance

Legal and Professional Services

Mileage Receipts

Misc. Items

(Any Expenses That Are Used to Operate the Use of Your Business)

HEALTHCARE EXPENSE

1095A

1095B

1095C

Download Taxpayer Checklist

Download Taxpayer Checklist